If we complete a foreign currency exchange on your behalf, such as exchanging a foreign currency incoming wire transfer into U.S. The exchange rate may vary among customers depending on your relationship, products with us, or the type of transaction being conducted, the dollar amount, type of currency, and the date and time of the exchange, and whether the transaction is a debit or credit to your account. The exchange rate we use will include a spread and may include commissions or other costs that we, our affiliates, or our vendors may charge in providing foreign currency exchange to you. There is NO FEE if the domestic wire transfer was sent from another Chase. You should expect that these foreign exchange rates will be less favorable than rates quoted online or in publications. Domestic and Foreign Incoming: A wire transfer that is deposited into your account. We may make a commission providing foreign currency exchange services to you. dollars using the applicable exchange rate without prior notice to you.įor additional information related to Wires and foreign currency wires, please see the Online Access Agreement or applicable service documentation.The foreign exchange rates we use are determined by us in our sole discretion. Incoming wire transfers received in a foreign currency for payment into your account will be converted into U.S. We may refuse to process any request for a foreign exchange transaction. Wells Fargo is your arms-length counterparty on foreign exchange transactions. Foreign exchange markets are dynamic and rates fluctuate over time based on market conditions, liquidity, and risks. Performed wire repair test key functions to accurately test incoming/outgoing. Different customers may receive different rates for transactions that are the same or similar, and the applicable exchange rate may be different for foreign currency cash, drafts, checks, or wire transfers. Researched inquiries for wire transfers both domestic and foreign banks. The exchange rate Wells Fargo provides to you may be different from exchange rates you see elsewhere. Whether you can make wire payments with Capital One will depend on the account type you have. There is a USD15 charge for wire payments arriving in Essential Checking, High-Yield Checking and Essential Savings accounts.

#Chase domestic incoming wire fee free#

The applicable exchange rate does not include, and is separate from, any applicable fees. Incoming wire payments are fee free for most accounts. The markup is designed to compensate us for several considerations including, without limitation, costs incurred, market risks, and our desired return. The exchange rate used when Wells Fargo converts one currency to another is set at our sole discretion, and it includes a markup. In addition to any applicable fees, Wells Fargo makes money when we convert one currency to another currency for you. If you’re transferring money to an account at another bank, however, the receiving bank may charge an incoming wire transfer fee.

#Chase domestic incoming wire fee code#

New Zealand, Cook Islands, Niue, Pitcairn and Tokelau: New Zealand Clearing Code MORE LIKE THISPayments and Money TransfersBankingA wire transfer is an electronic method for moving money from one bank account to another. Fees for receiving a wire transfer vary by account type.Canada: Canadian Payment Routing Number.

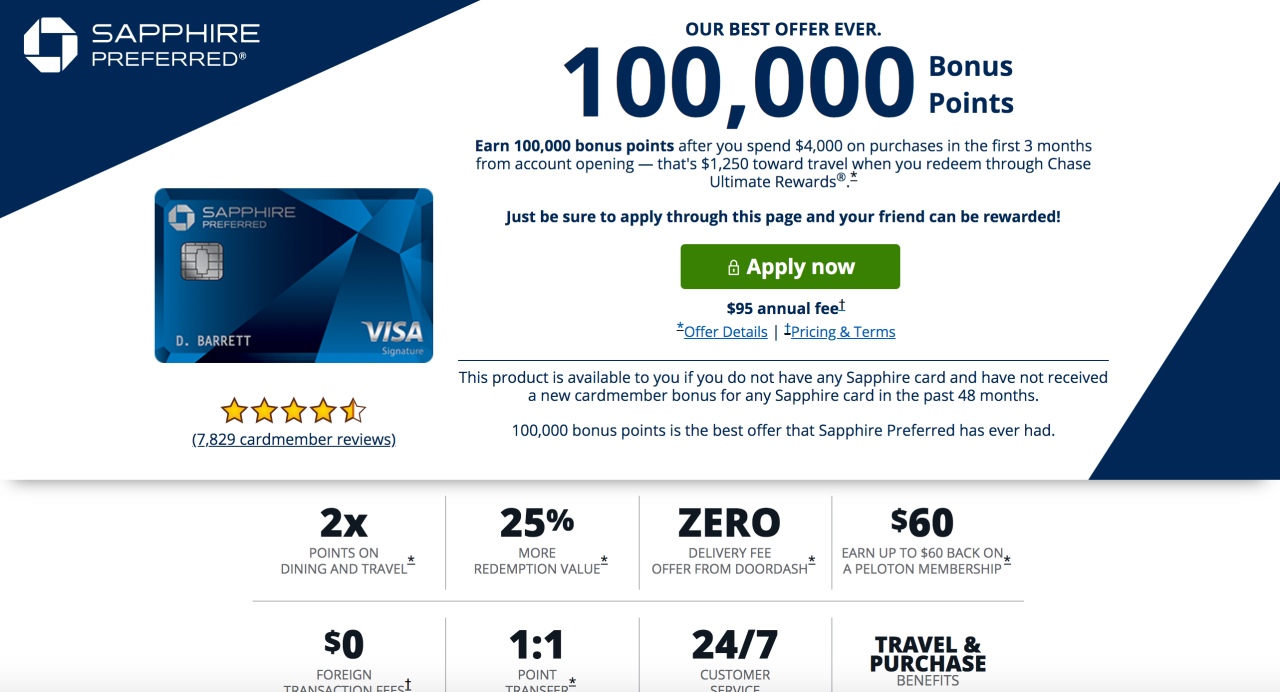

Australia: Australian Branch Code (BSB).Depending on the country, we may ask you to provide an IBAN when you send an international wire transfer.Ĭertain countries require additional codes as follows: An IBAN identifies specific bank accounts at international banks. Your recipient’s International Bank Account Number (IBAN).If you don’t know this, contact your recipient’s bank. A SWIFT code or Bank Identification Code (BIC) identifies the bank that will receive your wire transfer. The SWIFT/BIC for your recipient’s bank.To send an international wire, you will also need: If you don’t know your routing number, we can look it up for you on the Add Recipient screen. Chase Bank has many fees that many people ignore or pay off with out thinking, but they can add up. The routing (ABA/RTN) number for your recipient’s bank.To send a domestic wire, you will also need:

0 kommentar(er)

0 kommentar(er)